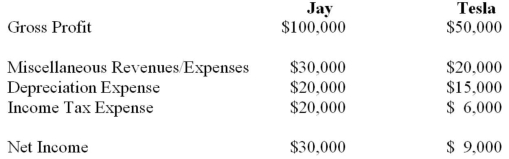

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of non-controlling interest in Jay's 2013 Consolidated Net Income would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of non-controlling interest in Jay's 2013 Consolidated Net Income would be:

A) Nil.

B) $1,458.

C) $1,800.

D) $1,818.

Correct Answer:

Verified

Q1: Duff Inc. owns 75% of Paddy Corp.

Q3: Jay Inc. owns 80% of Tesla Inc.

Q4: Rin owns 90% of Stempy Inc. On

Q5: Jay Inc. owns 80% of Tesla Inc.

Q6: Rin owns 90% of Stempy Inc. On

Q7: Duff Inc. owns 75% of Paddy Corp.

Q8: Jay Inc. owns 80% of Tesla Inc.

Q9: Duff Inc. owns 75% of Paddy Corp.

Q10: Rin owns 90% of Stempy Inc. On

Q11: Jay Inc. owns 80% of Tesla Inc.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents