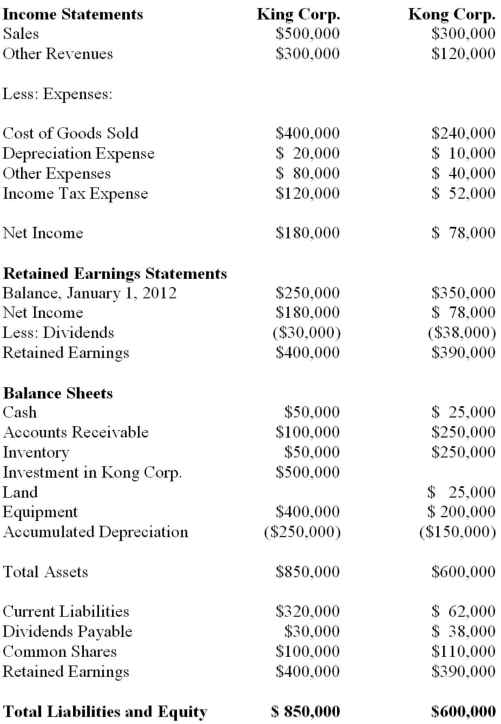

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount appearing on the December 31, 2012 Consolidated Income Statement for cost of goods sold?

A) $640,000.

B) $593,000.

C) $590,000.

D) $400,000.

Correct Answer:

Verified

Q27: King Corp. owns 80% of Kong Corp.

Q28: King Corp. owns 80% of Kong Corp.

Q29: King Corp. owns 80% of Kong Corp.

Q30: Ting Corp. owns 75% of Won Corp.

Q31: King Corp. owns 80% of Kong Corp.

Q33: King Corp. owns 80% of Kong Corp.

Q34: King Corp. owns 80% of Kong Corp.

Q35: King Corp. owns 80% of Kong Corp.

Q36: Ting Corp. owns 75% of Won Corp.

Q37: Ting Corp. owns 75% of Won Corp.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents