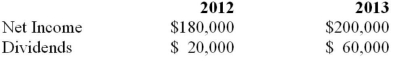

Hot Inc. owns 60% of Cold Inc, which it purchased on January 1, 2012 for $540,000. On that date, Cold's retained earnings and common stock were valued at $100,000 and $250,000 respectively. Cold's book values approximated its fair market values on that date, with the exception of the company's Inventory and a patent identified on acquisition. The patent had an estimated useful life of 10 years from the date of acquisition. The inventory had a book value that was $10,000 in excess of its fair value, while the patent had a fair market value of $50,000. Hot uses the equity method to account for its investment in Cold Inc. The inventory on hand on the acquisition date was sold to outside parties during the year. Hot Inc. sold depreciable assets to Cold on January 1, 2012, at a loss of $15,000. On January 1, 2013, Cold sold depreciable assets to Hot at a gain of $10,000 Both assets had a remaining useful life of 5 years on the date of their intercompany sale. During 2012, Cold sold inventory to Hot in the amount of $18,000. This inventory was sold to outside parties during 2013. During 2013, Hot sold inventory to Cold for $45,000. One third of this inventory was still in Cold's warehouse on December 31, 2013. All sales (both internal and external) are priced to provide the seller with a mark-up of 50% above cost. Cold's Net Income and Dividends for 2012 and 2013 are shown below.  Both companies are subject to a tax rate of 20%. Compute the Balance in Hot's Investment in Cold account as at December 31, 2013

Both companies are subject to a tax rate of 20%. Compute the Balance in Hot's Investment in Cold account as at December 31, 2013

Correct Answer:

Verified

Q50: Ting Corp. owns 75% of Won Corp.

Q51: The Financial Statements of Plax Inc. and

Q52: Ting Corp. owns 75% of Won Corp.

Q53: The Financial Statements of Plax Inc. and

Q54: Hot Inc. owns 60% of Cold Inc,

Q56: Ting Corp. owns 75% of Won Corp.

Q57: Ting Corp. owns 75% of Won Corp.

Q58: The Financial Statements of Plax Inc. and

Q59: Ting Corp. owns 75% of Won Corp.

Q60: Ting Corp. owns 75% of Won Corp.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents