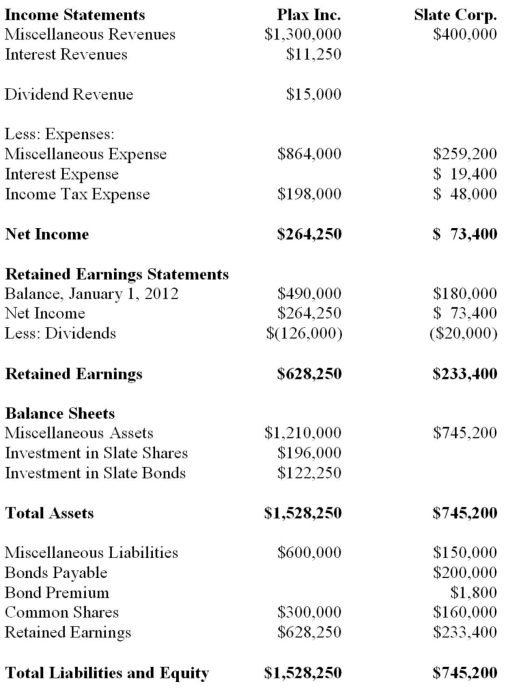

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 chapters)  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare a Statement of Consolidated Retained Earnings for the year ended December 31, 2012 for Plax Inc.

Correct Answer:

Verified

Q36: Ting Corp. owns 75% of Won Corp.

Q37: Ting Corp. owns 75% of Won Corp.

Q38: King Corp. owns 80% of Kong Corp.

Q39: Ting Corp. owns 75% of Won Corp.

Q40: Ting Corp. owns 75% of Won Corp.

Q42: Ting Corp. owns 75% of Won Corp.

Q43: Ting Corp. owns 75% of Won Corp.

Q44: The Financial Statements of Plax Inc. and

Q45: Hot Inc. owns 60% of Cold Inc,

Q46: The Financial Statements of Plax Inc. and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents