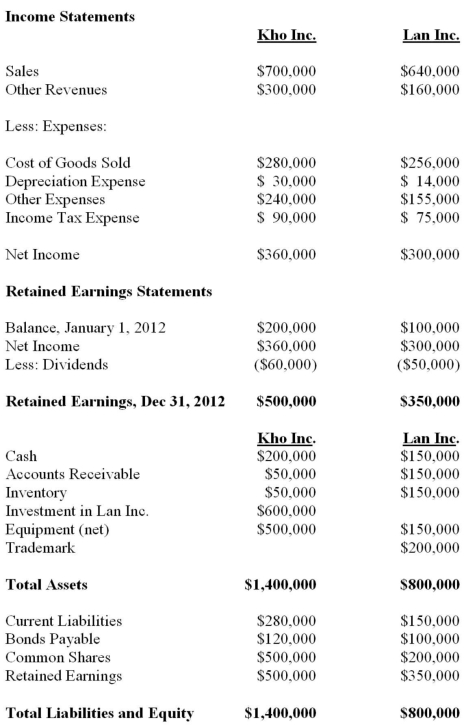

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2011. On that date, Lan's commons stock and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions: Lan's trademark had a fair value which was $50,000 higher than its carrying value. Lan's bonds payable had a fair value which was $20,000 higher than their carrying value. The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2021. Both companies use straight line amortization exclusively. The Financial Statements of both companies for the Year ended December 31, 2012 are shown below:  Other Information: A goodwill impairment test conducted during August 2012 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000. During 2011, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2012, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties. During 2011, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2012, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 20%. Ignoring taxes, what is the total amount of unrealized profits in inventory at the end of 2012?

Other Information: A goodwill impairment test conducted during August 2012 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000. During 2011, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2012, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties. During 2011, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2012, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 20%. Ignoring taxes, what is the total amount of unrealized profits in inventory at the end of 2012?

A) Nil.

B) $6,000.

C) $7,800.

D) $8,000.

Correct Answer:

Verified

Q1: Kho Inc. purchased 90% of the voting

Q2: Under which of the following Theories is

Q4: X Inc. owns 80% of Y Inc.

Q5: Under which of the following Consolidation Theories

Q6: Kho Inc. purchased 90% of the voting

Q7: How would any management fees charged by

Q9: Kho Inc. purchased 90% of the voting

Q10: X Inc. owns 80% of Y Inc.

Q11: Intercompany profits on sales of inventory are

Q18: If a parent company borrows money from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents