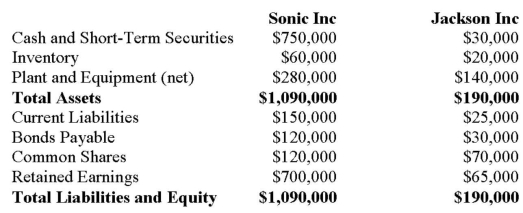

Sonic Enterprises Inc has decided to purchase 100% of the voting shares of Jackson Inc. for $300,000 in Cash on May 1, 2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of Jackson's Assets and Liabilities were as follows:

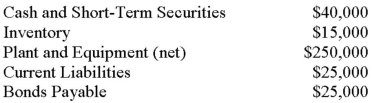

On that date, the fair values of Jackson's Assets and Liabilities were as follows:  Sonic's Book Values approximated their Fair Values on that date. a) Calculate the amount of Goodwill arising from this combination. b) Prepare the journal entry to record Sonic's acquisition of Jackson's Shares. c) Prepare Sonic's Consolidated Balance Sheet immediately following its acquisition of Jackson's assets.

Sonic's Book Values approximated their Fair Values on that date. a) Calculate the amount of Goodwill arising from this combination. b) Prepare the journal entry to record Sonic's acquisition of Jackson's Shares. c) Prepare Sonic's Consolidated Balance Sheet immediately following its acquisition of Jackson's assets.

Correct Answer:

Verified

Q46: Which of the following is NOT considered

Q50: Telecom Inc has decided to purchase the

Q51: In general, which of the following statements

Q51: Great Western Manufacturing Inc. ("GWM") was acquired

Q53: Company A makes an offer to purchase

Q53: Which of the following is NOT required

Q55: On April 1, 2012, the balance sheets

Q58: On April 1, 2012, the balance sheets

Q58: Which of the following is NOT considered

Q60: Company Inc. owns all of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents