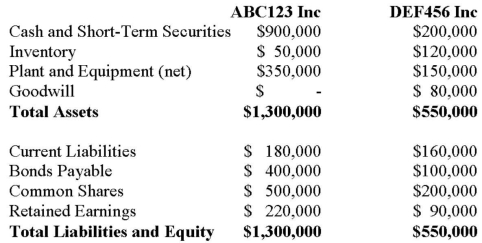

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July 1, 2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of DEF456 Assets and Liabilities were as follows:

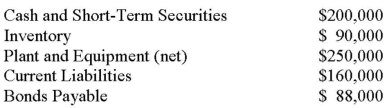

On that date, the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Prepare any disclosure required for ABC123 Inc. under IFRS. Assume DEF456 produces high-end loudspeakers for touring musicians.

In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Prepare any disclosure required for ABC123 Inc. under IFRS. Assume DEF456 produces high-end loudspeakers for touring musicians.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: When are parent companies allowed to comprehensively

Q36: Which of the following statements is correct?

A)

Q38: A Inc. purchases 100% of the voting

Q39: A Corporation had net income of $50,000

Q40: Which of the following is closest to

Q42: ABC123 Inc has decided to purchase 100%

Q43: George Inc. acquired all of the outstanding

Q44: ABC123 Inc has decided to purchase 100%

Q45: Telecom Inc has decided to purchase the

Q46: Telecom Inc has decided to purchase the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents