A not-for-profit organization received unrestricted pledges of $200,000, and believes based on past experience that 95% of them will be paid. What entry should be made to record the pledges?

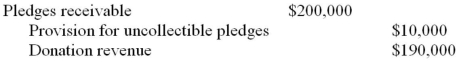

A)

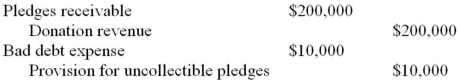

B)

C)

D)

Correct Answer:

Verified

Q46: Describe what fund accounting is and why

Q47: A not-for-profit organization receives a restricted contribution

Q52: How should a not-for-profit organization value inventories

Q52: How should outstanding commitments best be presented

Q53: Buana Fide is a local charity which

Q55: The following are selected transactions for HELP-ON-US,

Q56: XYZ is a local charity that commenced

Q59: The following are selected transactions from Helpers

Q60: Buana Fide is a local charity which

Q61: On January 1, 2013, some residents of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents