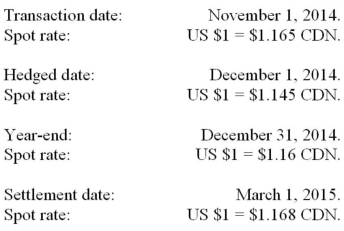

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  What is the amount of the exchange gain or loss from the recognition of the hedge discount recognized during 2014?

What is the amount of the exchange gain or loss from the recognition of the hedge discount recognized during 2014?

A) A loss of $4,500.

B) A loss of $3,000.

C) Nil.

D) A gain of $4,500.

Correct Answer:

Verified