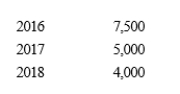

Molly has generated general business credits over the years that have not been utilized.The amounts generated and not utilized equal:

In the current year, 2019, her business generates an additional $15,000 general business credit.In 2019, based on her tax liability before credits, she can utilize a general business credit of up to $20,000.After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2019 is available for future years?

In the current year, 2019, her business generates an additional $15,000 general business credit.In 2019, based on her tax liability before credits, she can utilize a general business credit of up to $20,000.After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2019 is available for future years?

a.$0.

b.$1,000.

c.$14,000.

d.$15,000.

Correct Answer:

Verified

Total cr...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: If a taxpayer elects to capitalize and

Q29: Kay claimed percentage depletion of $119,000 for

Q30: Without the foreign tax credit, double taxation

Q54: Ahmad is considering making a $10,000 investment

Q57: Jackson sells qualifying small business stock for

Q58: Cardinal Corporation hires two persons who are

Q68: Which of the following, if any, correctly

Q71: Amber is in the process this year

Q72: During the year, Green, Inc., incurs the

Q78: In the renovation of its building, Green

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents