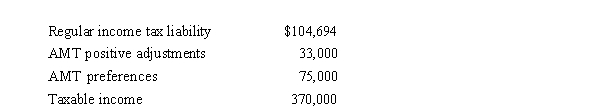

Beulah, who is single and itemizes deductions, provides you with the following information from her financial records for 2019.Compute Beulah's AMTI.

A) $0

B) $368,600

C) $407,700

D) $478,000

E) $490,000

Correct Answer:

Verified

Q42: Vicki owns and operates a news agency

Q46: Which of the following statements concerning capital

Q48: Dale owns and operates Dale's Emporium as

Q51: On February 1, 2019, Omar acquires used

Q53: Which of the following statements describing the

Q54: Wallace owns a construction company that builds

Q56: Each of A, B, and C is

Q58: Prior to the effect of tax credits,

Q75: In working with the foreign tax credit,

Q94: Ashby, who is single and age 30,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents