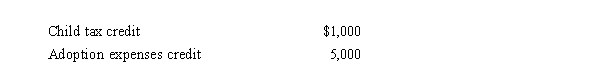

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000, and his tentative minimum tax is $195,000.Justin reports the following credits.  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A) $190,000

B) $194,000

C) $195,000

D) $200,000

Correct Answer:

Verified

Q43: Roger is considering making a $6,000 investment

Q43: For regular income tax purposes, Yolanda, who

Q44: Which of the following statements is correct?

A)If

Q45: The components of the general business credit

Q46: Which of the following statements concerning capital

Q47: Several years ago, Sarah purchased a certified

Q52: Which of the following correctly describes the

Q54: Wallace owns a construction company that builds

Q56: Each of A, B, and C is

Q57: Jackson sells qualifying small business stock for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents