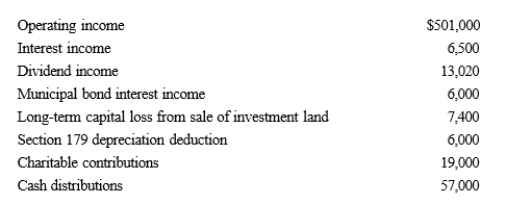

Amit, Inc., an S corporation, holds an AAA balance of $614,000 at the beginning of the tax year.During the year, the following items occur.  Amit's ending AAA balance is:

Amit's ending AAA balance is:

A) $1,055,620.

B) $1,185,150.

C) $1,191,150.

D) $1,242,150.

E) Some other amount.

Correct Answer:

Verified

Q61: Fred is the sole shareholder of an

Q65: On January 2, 2019, David loans his

Q69: Which statement is incorrect with respect to

Q76: You are given the following facts about

Q76: A new S corporation shareholder can revoke

Q79: Which item does not appear on Schedule

Q80: On January 2, 2019, Tim loans his

Q90: Mock Corporation converts to S corporation status

Q97: The choice of a flow-through entity for

Q100: This year, Jiang, the sole shareholder of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents