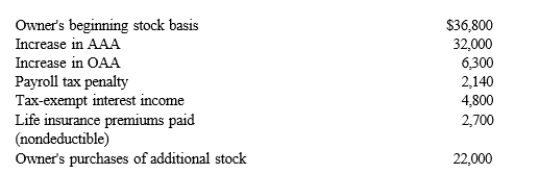

You are given the following facts about a 40% owner of an S corporation.Calculate her ending stock basis.

A) $71,600

B) $74,120

C) $76,220

D) $78,920

Correct Answer:

Verified

Q50: Which statement is incorrect?

A) S corporations are

Q51: Compensation for services rendered to an S

Q54: An S corporation must possess which of

Q56: Several individuals acquire assets on behalf of

Q60: The exclusion of gain on disposition of

Q64: Which of the following items, if any,

Q66: If an S corporation's beginning balance in

Q67: During the year, Miles Nutt, the sole

Q70: Samantha owned 1,000 shares in Evita, Inc.,

Q74: Kinney, Inc., an electing S corporation, holds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents