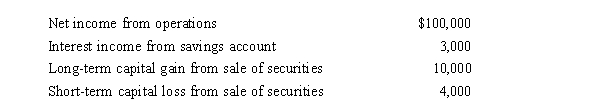

Oxen Corporation incurs the following transactions.  Oxen maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder, Megan.As a result, Megan must recognize (ignore 20% QBI deduction) :

Oxen maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder, Megan.As a result, Megan must recognize (ignore 20% QBI deduction) :

A) Ordinary income of $103,000.

B) Ordinary income of $103,000 and long-term capital gain of $6,000.

C) Ordinary income of $103,000, long-term capital gain of $10,000, and $4,000 short-term capital loss.

D) Ordinary income of $109,000.

Correct Answer:

Verified

Q81: If an S corporation has C corporation

Q83: Shareholders owning a(n) of shares (voting and

Q84: Some _and taxation rules apply to an

Q85: A calendar year C corporation reports a

Q87: Lent Corporation converts to S corporation status

Q88: An S corporation is limited to a

Q89: Which of the following items, if any,

Q91: Donna and Mark are married and file

Q93: Lemon Corporation incurs the following transactions.

Q94: As with partnerships, the income, deductions, and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents