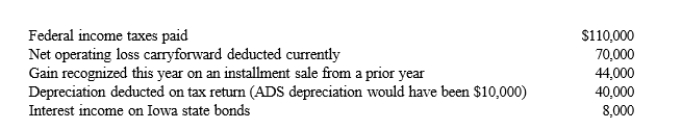

Rose Corporation (a calendar year taxpayer) has taxable income of $300,000, and its financial records reflect the following for the year.  Rose Corporation's current E & P is:

Rose Corporation's current E & P is:

A) $254,000.

B) $214,000.

C) $194,000.

D) $104,000.

E) None of these.

Correct Answer:

Verified

Q42: The tax treatment of corporate distributions at

Q45: Silver Corporation, a calendar year taxpayer, has

Q46: Cedar Corporation is a calendar year taxpayer

Q61: Tern Corporation, a cash basis taxpayer, has

Q63: Aaron and Michele, equal shareholders in Cavalier

Q64: Stacey and Eva each own one-half of

Q68: Robin Corporation, a calendar year taxpayer, has

Q69: Which of the following statements is incorrect

Q75: On January 2, 2019, Orange Corporation purchased

Q80: Falcon Corporation ended its first year of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents