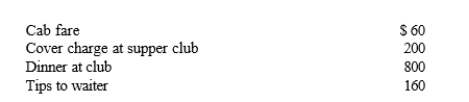

Robert entertains several of his key clients on January 1 of the current year.Expenses that he paid are as follows:  Presuming proper substantiation, Robert's deduction is:

Presuming proper substantiation, Robert's deduction is:

A) $610.

B) $640.

C) $740.

D) $1,220.

E) None of these.

Correct Answer:

Verified

Q70: Louise works in a foreign branch of

Q72: Under the actual cost method, which of

Q73: Which of the following, if any, is

Q75: A U.S.citizen worked in a foreign country

Q85: Which of the following expenses, if any,

Q90: Which of the following, if any, is

Q107: During the year, Walt (self-employed) travels from

Q109: Ralph made the following business gifts during

Q112: Corey is the city sales manager for

Q116: During the year, Sophie (a self-employed marketing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents