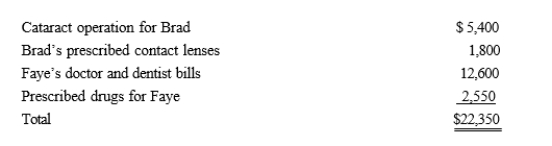

Brad, who would otherwise qualify as Faye's dependent, had gross income of $9,000 during the year.Faye, who had AGI of $120,000, paid the following medical expenses this year:  Faye has a medical expense deduction of:

Faye has a medical expense deduction of:

A) $3,150

B) $4,950

C) $10,350

D) $13,350

E) None of these

Correct Answer:

Verified

Q55: Fred and Lucy are married, ages 33

Q58: Edna had an accident while competing in

Q66: Brad, who uses the cash method of

Q70: In the current year, Jerry pays $8,000

Q78: Tommy, a senior at State College, receives

Q90: The exclusion of interest on educational savings

Q91: Assuming a taxpayer qualifies for the exclusion

Q106: Early in the year, Marlon was in

Q112: Zeke made the following donations to qualified

Q113: Richard, age 50, is employed as an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents