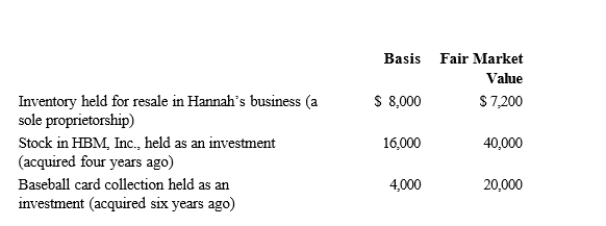

Hannah makes the following charitable donations in the current year:  The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

A) $28,000.

B) $51,200.

C) $52,000.

D) $67,200.

E) None of these.

Correct Answer:

Verified

Q44: Theresa sued her former employer for age,

Q49: Jack received a court award in a

Q55: Fred and Lucy are married, ages 33

Q66: Brad, who uses the cash method of

Q78: Tommy, a senior at State College, receives

Q80: This year, Carol, a single taxpayer, purchased

Q112: Zeke made the following donations to qualified

Q113: Richard, age 50, is employed as an

Q118: Nancy paid the following taxes during the

Q120: Hugh, a self-employed individual, paid the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents