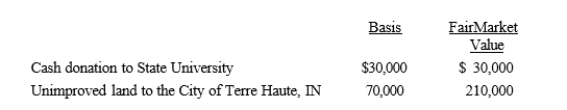

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations during the year:  The land had been held as an investment and was acquired four years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction this year is:

The land had been held as an investment and was acquired four years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction this year is:

A) $100,000.

B) $165,000.

C) $225,000.

D) $240,000.

E) None of these.

Correct Answer:

Verified

Q42: Olaf was injured in an automobile accident

Q54: Christie sued her former employer for a

Q56: As an executive of Cherry, Inc., Ollie

Q58: Edna had an accident while competing in

Q70: In the current year, Jerry pays $8,000

Q72: Byron owned stock in Blossom Corporation that

Q81: The amount of Social Security benefits received

Q83: The taxable portion of Social Security benefits

Q90: The exclusion of interest on educational savings

Q106: Early in the year, Marlon was in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents