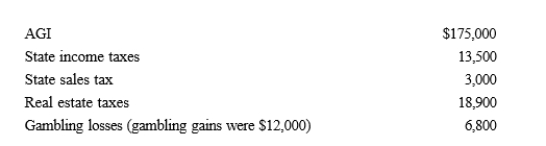

Paul, a calendar year single taxpayer, has the following information for 2019:  Paul's allowable itemized deductions for 2019 are:

Paul's allowable itemized deductions for 2019 are:

A) $10,000.

B) $16,800.

C) $39,200.

D) $42,200.

E) None of these.

Correct Answer:

Verified

Q43: Roger is considering making a $6,000 investment

Q44: Theresa sued her former employer for age,

Q49: Jack received a court award in a

Q54: Ahmad is considering making a $10,000 investment

Q62: Pat gave 5,000 shares of stock in

Q74: Which of the following, if any, correctly

Q80: This year, Carol, a single taxpayer, purchased

Q118: Nancy paid the following taxes during the

Q120: Hugh, a self-employed individual, paid the following

Q124: During the current year, Ralph made the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents