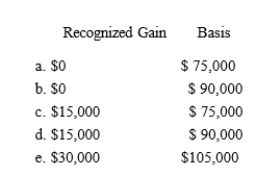

Nat is a salesman for a real estate developer.His employer permits him to purchase a lot for $75,000.The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Correct Answer:

Verified

Q27: Kelly, who is single, sells her principal

Q35: Matt, who is single, sells his principal

Q41: Capital recoveries include:

A)The cost of capital improvements.

B)Ordinary

Q42: Abby exchanges an SUV that she has

Q44: Janice bought her house in 2010 for

Q46: Carlton purchases land for $550,000.He incurs legal

Q60: Yolanda buys a house in the mountains

Q62: Karen owns City of Richmond bonds with

Q66: Joyce's office building was destroyed in a

Q70: Katie sells her personal use automobile for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents