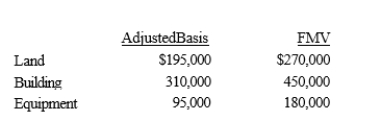

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

Correct Answer:

Verified

Q50: Which, if any, of the following exchanges

Q68: Ralph gives his daughter, Angela, stock (basis

Q69: Noelle received dining room furniture as a

Q80: Shontelle received a gift of income-producing property

Q81: Karen purchased 100 shares of Gold Corporation

Q84: On January 2, 2019, Todd converts his

Q90: Arthur owns a tract of undeveloped land

Q91: Under the Internal Revenue Code, the holding

Q96: Alice owns land with an adjusted basis

Q122: Terry owns Lakeside, Inc.stock (adjusted basis of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents