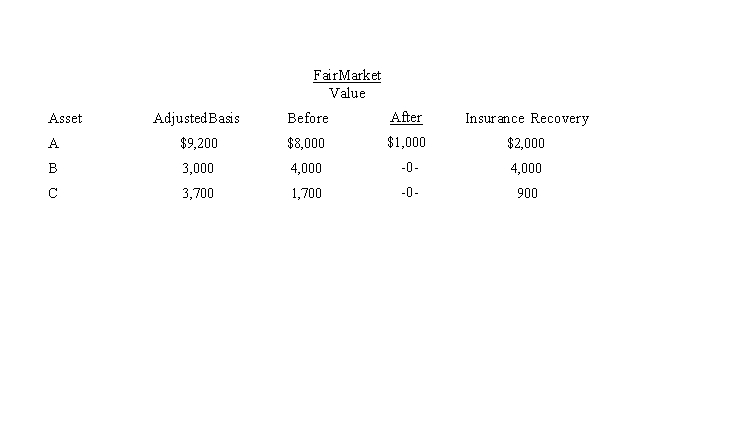

In 2019, Wally had the following insured personal casualty losses (arising from one casualty in a Federally declared disaster area) .Wally also had $42,000 AGI for the year before considering the casualty.  Wally's casualty loss deduction is:

Wally's casualty loss deduction is:

A) $1,500.

B) $1,600.

C) $4,800.

D) $58,000.

E) None of these.

Correct Answer:

Verified

Q41: Two years ago, Gina loaned Tom $50,000.Tom

Q41: Joyce, an architect, earns $100,000 from her

Q42: Kathy, who is a real estate professional,

Q45: In 2019, Joanne invested $90,000 for a

Q46: Jennifer gave her interest in a passive

Q55: Mary incurred a $20,000 nonbusiness bad debt

Q60: Peggy is in the business of factoring

Q78: John files a return as a single

Q95: Five years ago, Tom loaned his son

Q102: In 2019, Morley, a single taxpayer, had

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents