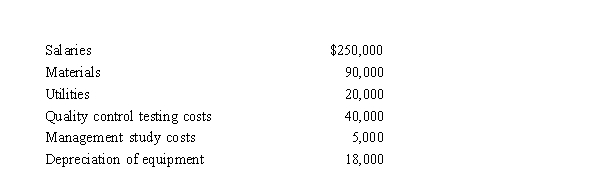

Last year, Green Corporation incurred the following expenditures in the development of a new plant process:  During the current year, benefits from the project began being realized in May.If Green Corporation elects a 60 month deferral and amortization period, determine the amount of the deduction for the current year.

During the current year, benefits from the project began being realized in May.If Green Corporation elects a 60 month deferral and amortization period, determine the amount of the deduction for the current year.

A) $48,000

B) $50,400

C) $54,667

D) $57,067

E) None of these.

Correct Answer:

Verified

Q41: Grape Corporation purchased a machine in December

Q43: Tan Company acquires a new machine (10-year

Q47: Alice purchased office furniture on September 20,

Q49: On May 30, 2018, Jane purchased a

Q50: Cora purchased a hotel building on May

Q52: White Company acquires a new machine (seven-year

Q55: Hazel purchased a new business asset (five-year

Q62: Plum Corporation (a C corporation and a

Q109: Owl Corporation (a C corporation), a retailer

Q116: Wanda is the Chief Executive Officer of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents