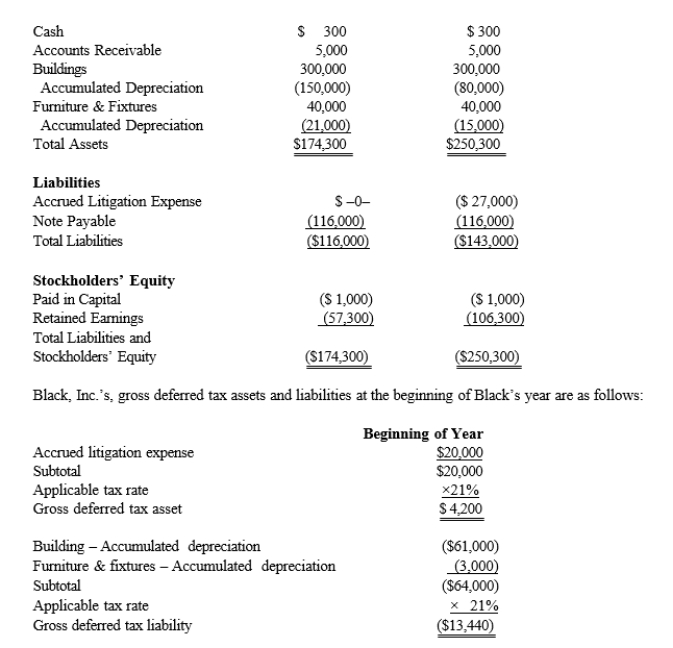

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 21% corporate tax rate and no valuation allowance. Assets Tax Debit/(Credit) Book Debit/(Credit)  Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences. It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense.Determine the change in Black's deferred tax assets for the current year.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences. It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense.Determine the change in Black's deferred tax assets for the current year.

Correct Answer:

Verified

Q41: Which of the following items is not

Q43: Bunker, Inc., is a domestic corporation. It

Q44: Which of the following items is not

Q45: Ursula, Inc. is a domestic corporation. It

Q50: Which of the following statements best describes

Q51: Black, Inc., is a domestic corporation with

Q52: Cold, Inc., reported a $100,000 total tax

Q56: Hot, Inc.'s primary competitor is Cold, Inc.

Q56: JiangCo constructs the following table in determining

Q58: In the typical case, the taxpayer would

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents