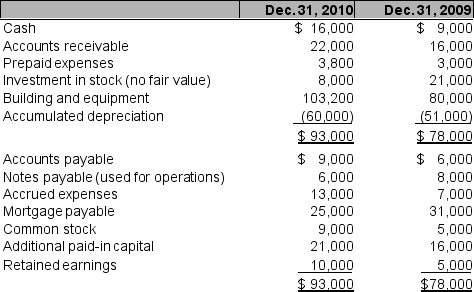

Richards Inc. presented its comparative financial data and other data as follows:

Additional information:

Additional information:

1. Equipment was purchased for $43,200 and was paid in cash. Other equipment was sold at a $3,000 gain and was 50% depreciated at the time of sale.

2. During 2009, Richards Inc. declared and paid cash dividends.

3. Part of the investment in the stock portfolio was sold at book value. The stock is closely-held so no fair value adjustments are made.

4. Net income was $49,000.

Prepare a statement of cash flows using the indirect method for 2010. You may omit the heading.

Correct Answer:

Verified

Q54: The following information was taken from the

Q55: Accrued wages payable on December 31, 2008

Q55: The August 1 and August 31 balances

Q56: Q57: Relevant account balances for Martinez Corporation are: Q58: The following information was taken from the Q60: Beginning and ending balances for relevant balance Q60: Wilson Corporation reported cost of goods sold Q62: The following are relevant account balances from Q71: Benton Company reported insurance expense of $301,000![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents