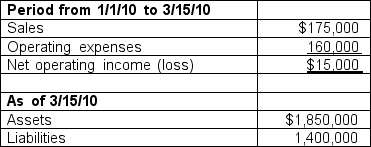

Gleeson Industries consists of four separate divisions: compressed wood products, chemicals, stone products, and plastics. On March 15, 2010, Gleeson sold the chemicals division for $625,000 cash. Financial information related to the chemicals division follows:

If the income tax rate for the company is 35%, what amount of income tax liability on the disposal of the business segment will be recognized?

If the income tax rate for the company is 35%, what amount of income tax liability on the disposal of the business segment will be recognized?

a. $218,750

b. $61,250

c. $5,250

d. $157,500

Correct Answer:

Verified

Q45: Sunrise Designs maintains a credit line with

Q46: The following income statement was reported by

Q47: The management of Hammer Enterprises shares in

Q48: Sunrise Designs maintains a credit line with

Q49: Gleeson Industries consists of four separate divisions:

Q51: Nigel Corporation reported income from continuing operations

Q52: On January 1, total assets and liabilities

Q53: The following income statement was reported by

Q54: Cabell Inc. reported 'income from operations

Q55: On January 1 and December 31, 2010,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents