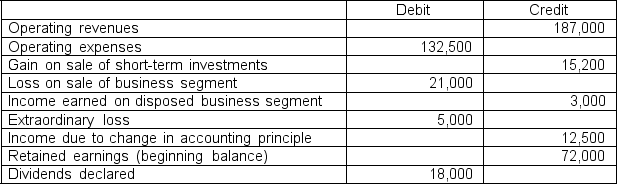

The following information was taken from the 2010 financial records of Hopewell Company.

The company's income tax rate is 35 percent, and the items above are treated identically for the financial reporting and tax purposes.

The company's income tax rate is 35 percent, and the items above are treated identically for the financial reporting and tax purposes.

REQUIRED:

Prepare an income statement using this information.

Correct Answer:

Verified

Q51: Nigel Corporation reported income from continuing operations

Q52: On January 1, total assets and liabilities

Q53: The following income statement was reported by

Q54: Cabell Inc. reported 'income from operations

Q55: On January 1 and December 31, 2010,

Q57: Wellman Inc., a computer manufacturer located in

Q58: On January 1, total assets and liabilities

Q59: Makar Corporation reported net income before extraordinary

Q60: Sunrise Designs maintains a credit line with

Q72: Identify the GAAP requirements of comprehensive income.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents