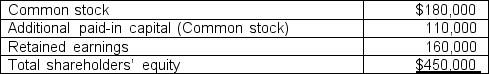

The shareholders' equity section of Jason Company as of December 31, 2010 follows:

On January 15, the company repurchased 1,500 shares of its own stock at $60 for treasury stock. On January 16, as part of a compensation package, the company reissued half of the treasury shares to executives who exercised stock options for $20 per share. On January 28, the company reissued the remainder of the treasury stock on the open market for $66 per share. Which of the following would be included in the journal entry recorded on January 16?

On January 15, the company repurchased 1,500 shares of its own stock at $60 for treasury stock. On January 16, as part of a compensation package, the company reissued half of the treasury shares to executives who exercised stock options for $20 per share. On January 28, the company reissued the remainder of the treasury stock on the open market for $66 per share. Which of the following would be included in the journal entry recorded on January 16?

a. a debit to Cash for $15,000.

b. a debit to Treasury Stock for $45,000.

c. a credit to Additional Paid-In Capital for $45,000.

d. a credit to Additional Paid-In Capital for $15,000.

Correct Answer:

Verified

Q30: The declaration of cash dividends

A)increases total expenses.

B)decreases

Q33: Dividends in arrears on cumulative preferred stock

A)increase

Q35: If preferred stock is participating, then

A)preferred dividends

Q37: On January 1, 2010, Susann, Inc. declared

Q38: Which one of the following events decreases

Q42: The following information was taken from the

Q43: The shareholders' equity section of Winters Company

Q44: Chambers Corporation has total assets of $800,000

Q45: The shareholders' equity section of Winters Company

Q46: The shareholders' equity section of the Jason

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents