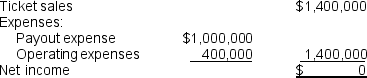

Crawford Company conducts a lottery system for Mississippi. The agreement specifies that the lottery must be conducted on a not-for-profit basis. Crawford's monthly sales of lottery tickets amounts to $1,400,000. Monthly operating expenses are $400,000, including a management charge of $30,000. The payment schedule for the guaranteed $1 million dollar payout for a winning lottery ticket is $100,000 immediately and $100,000 each year for the next 9 years. Crawford produced the following income statement as evidence of its not-for-profit status:

A. If the market rate of interest is 4%, determine the present value of the $900,000 liability arising from the monthly winning lottery ticket.

A. If the market rate of interest is 4%, determine the present value of the $900,000 liability arising from the monthly winning lottery ticket.

B. Recalculate the income statement to reflect GAAP measurement of payout expense.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Calculate the effective interest rate on these

Q102: Various contractual forms specify additional terms such

Q104: Felton Incorporated is considering leasing equipment. It

Q106: What are 'off-balance sheet risks'? What disclosures

Q107: Why might a company redeem bonds before

Q109: Branson Incorporated is considering leasing equipment. It

Q112: What is the risk premium of a

Q113: Distinguish between an installment obligation and a

Q114: Why are some types of leases recorded

Q116: When the effective interest method is used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents