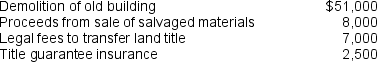

On December 1, Douglas Corp. purchased a tract of land for $285,000 to be used as a factory site. An old unusable building on the land was razed (torn down) , and the salvaged materials from the demolition were sold. These cash expenditures and receipts and other costs incurred during December are as follows:  What would be the balance in Douglas's Land account on its December 31 balance sheet?

What would be the balance in Douglas's Land account on its December 31 balance sheet?

A) $285,000

B) $337,500

C) $340,500

D) $331,000

Correct Answer:

Verified

Q45: Once a plant asset becomes fully depreciated,

Q52: On January 1, Mondale Co. paid $92,000

Q53: On February 1, 2008, James Co., which

Q54: Land and a building were purchased for

Q55: Jeter Inc. acquired machinery on January 1,

Q56: During 2009, Erie Inc. developed a new

Q59: On July 31, 2010, equipment is purchased

Q61: The following items represent common post acquisition

Q62: Lincoln Co. purchased a piece of property

Q63: Land and a building were purchased for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents