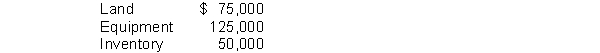

Farmdale Company purchased three assets for $400,000. These assets have fair market values as follows:  If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the equipment?

If you were Farmdale's accountant, how much of the lump sum purchase would you allocate to the equipment?

A) $100,000

B) $120,000

C) $200,000

D) $80,000

Correct Answer:

Verified

Q22: Natural resource costs:

A)include rights, privileges, and benefits

Q36: A machine was purchased on January 1

Q39: A machine was purchased on January 1

Q40: Sandeep Inc. uses double-declining-balance depreciation for an

Q45: Farmdale Company purchased three assets for $400,000.

Q46: When a plant asset is traded in

Q49: On January 1, Eagle Co. paid $65,000

Q53: Once a company establishes that an estimated

Q56: The calculation of a 'depreciation base' requires

Q58: Intangible assets differ from plant assets in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents