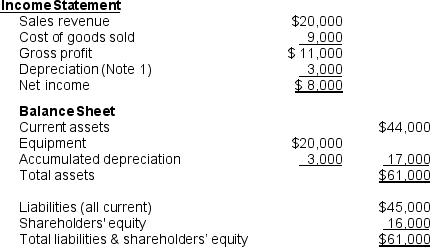

Mondova Corporation began operations on January 1. Below is Mondova's current net income statement and December 31 balance sheet calculated using straight-line depreciation.

Note 1: Equipment was purchased on January 1. Straight-line depreciation method was used with an estimated economic life of 5 years.

Note 1: Equipment was purchased on January 1. Straight-line depreciation method was used with an estimated economic life of 5 years.

A. Determine the estimated salvage value of the equipment being depreciated using the straight-line method.

B. Prepare an income statement and balance sheet in the same format as presented above assuming that Mondova Corporation uses the double-declining-balance depreciation method. The equipment has an estimated economic life of 5 years.

C. Calculate and compare Mondova's December 31 current ratio, debt/equity ratio, and debt to assets ratio using the financial statements constructed using the straight-line and double-declining-balance methods of depreciation.

Correct Answer:

Verified

DDB Depreciation expense and accumul...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Identify the role of the matching principle

Q88: On January 1, the balance in accumulated

Q89: How should management choose an acceptable cost

Q93: What are post-acquisition expenditures? How are they

Q103: Intangible assets can be divided into two

Q105: How do long-lived assets differ from inventory?

Q114: The balance of accumulated depreciation on January

Q115: Dorman Company purchased a new web server

Q117: Many years ago, a well-known American company

Q118: Use the information that follows to answer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents