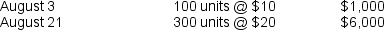

Summers Company began business on August 1, 2010. During August, Summers made the following purchases:

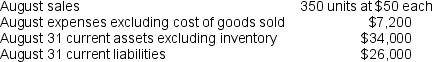

Other information provided:

Other information provided:

Calculate Summers' August 31 ending inventory under the FIFO and LIFO cost flow assumptions.

Calculate Summers' August 31 ending inventory under the FIFO and LIFO cost flow assumptions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Warren Trading pays for its inventory purchases

Q83: Use the information that follows concerning

Q91: Use the information that follows concerning Yarley's

Q92: Use the information that follows concerning

Q94: Use the information that follows concerning Ruby

Q95: A firm fraudulently overstated its December 31,

Q95: Ruby uses the FIFO cost flow assumption.

Q99: Use the information that follows concerning Cinci

Q100: Ruby uses the LIFO cost flow assumption.

Q112: After studying a financial accounting text, your

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents