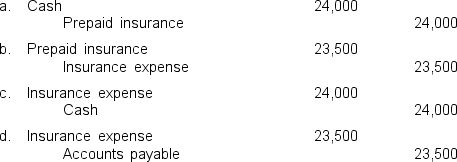

On December 13, 2010, Tucson Corp. paid $24,000 for a two year property insurance policy covering their corporate headquarters for the period December 15, 2010 to December 15, 2012. The payment was charged to insurance expense. What adjusting entry is needed at the end of December?

Correct Answer:

Verified

Q42: The biggest distinction between accruals and deferrals

Q43: A multinational is

A)a company that prepares accruals

Q67: During Bisbee's first year of business, office

Q68: If accounts receivable on January 1 totals

Q69: On January 1, Wages Payable for Flagstaff

Q70: On August 1, Amy Company borrowed $38,000

Q71: On December 31, 2010, immediately after all

Q73: Meadville, Inc. began operations during 2010.

Q75: Able Industries has the following information

Q76: On December 31, 2010, immediately after all

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents