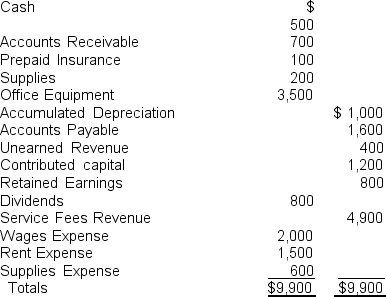

Use the information that follows taken from the unadjusted accounting records of Sheena, Inc. for the year ending December 31, 2010 to answer problems 24 through 26.

The following information is needed for adjusting entries at the end of December.

The following information is needed for adjusting entries at the end of December.

a. On December 31, 2010, the insurance expired amounted to $80.

b. Of the unearned revenue, $250 of services had been performed.

c. Services have been performed for customers that have not yet been billed or paid totaling $180.

d. The office equipment computation for 2010 depreciation amounts to $200.

-Determine total liabilities for Sheena, Inc. for the year ending December 31, 2010.

Correct Answer:

Verified

Q83: If interest payable on January 1 is

Q88: If interest payable on January 1 is

Q104: Accounts receivable on January 1 and December

Q105: Use the information that follows taken from

Q106: Given below is the Accounts Receivable T-account.

Q109: Dora Manufacturing, a capital-intensive company that manufactures

Q111: The following are amounts from the accounting

Q113: Retained earnings on January 1 was $27,000.

Q114: Inventory on January 1 and December 31

Q115: Inventory on January 1 and December 31

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents