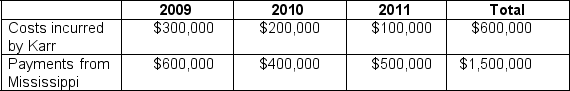

Karr Construction built a levee for the state of Mississippi over a three-year period. The contracted price for the levee was $1,200,000. The costs incurred by Karr and the payments from the state over the three year period are as follows:  If revenue is recognized when payments are received, which of the following present the net income amounts reported in 2009, 2010, and 2011, respectively?

If revenue is recognized when payments are received, which of the following present the net income amounts reported in 2009, 2010, and 2011, respectively?

A) $600,000; $400,000; $500,000

B) $300,000; $200,000; $400,000

C) $400,000; $400,000; $400,000

D) $300,000; $200,000; $100,000

Correct Answer:

Verified

Q8: The monetary unit that a company uses

Q10: Everett, Inc.'s reporting period ends on June

Q31: Objective accounting information:

A)cannot be used in the

Q45: The most common point of revenue recognition

Q52: Jeter Company ordered 400 toy wagons from

Q54: Morgan Shipping held cash of $1 million

Q55: Equipment with an original cost of $39,000

Q57: Sheena Company has accounts receivable of $13,000,

Q60: Why would a company recognize the cost

Q61: Equipment with an original cost of $50,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents