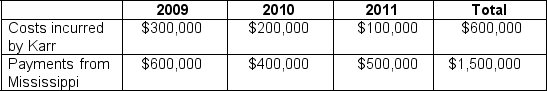

Karr Construction built a levee for the state of Mississippi over a three-year period. The contracted price for the levee was $1,200,000. The costs incurred by Karr and the payments from the state over the three year period are as follows:

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2010?

If revenue is recognized in proportion to the costs incurred by Karr, how much net income is reported in 2010?

a. $100,000

b. $200,000

c. $300,000

d. $400,000

Correct Answer:

Verified

Q67: On December 31, 2010, total assets and

Q68: Three years ago, Astro Masters, Inc. purchased

Q69: Short-term investments have an original cost of

Q70: Match the descriptions listed in letters a

Q71: During 2010, Hamot Company sold $30,000 of

Q73: During January of 2010, Barry Corporation purchased

Q74: Karr Construction built a levee for the

Q75: For each financial concept listed in 1

Q76: For each financial statement item listed in

Q77: Accounts receivable have a face value of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents