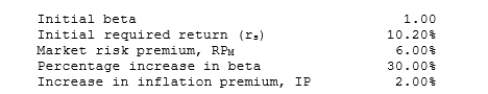

Data for Dana Industries is shown below. Now Dana acquires some risky assets that cause its beta to increase by 30%. In addition, expected inflation increases by 2.00%. What is the stock's new required rate of return?

A) 14.00%

B) 14.70%

C) 15.44%

D) 16.21%

E) 17.02%

Correct Answer:

Verified

Q122: Returns for the Dayton Company over the

Q123: Assume that your uncle holds just one

Q124: Consider the following information and then calculate

Q127: Engler Equipment has a beta of 0.88

Q130: Magee Inc.'s manager believes that economic conditions

Q132: Assume that you are the portfolio manager

Q139: Mulherin's stock has a beta of 1.23,its

Q143: Assume that you manage a $10.00 million

Q144: CCC Corp has a beta of 1.5

Q146: A mutual fund manager has a $40

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents