In order to accurately assess the capital structure of a firm, it is necessary to convert its balance sheet figures to a market value basis.

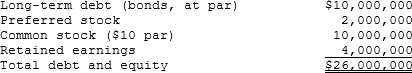

KJM Corporation's balance sheet as of today is as follows:

The bonds have a 4.0% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt?

A) $5,276,731

B) $5,412,032

C) $5,547,332

D) $7,706,000

E) $7,898,650

Correct Answer:

Verified

Q62: 5-year Treasury bonds yield 5.5%.The inflation premium

Q80: If 10-year T-bonds have a yield of

Q90: Wachowicz Corporation issued 15-year, noncallable, 7.5% annual

Q93: Assume that you are considering the purchase

Q94: Keys Corporation's 5-year bonds yield 7.00%, and

Q95: Taussig Corp.'s bonds currently sell for $1,150.

Q96: McCue Inc.'s bonds currently sell for $1,250.

Q97: Quigley Inc.'s bonds currently sell for $1,080

Q98: Consider some bonds with one annual coupon

Q100: Crockett Corporation's 5-year bonds yield 6.85%, and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents