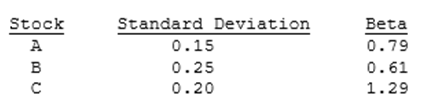

You have the following data on three stocks:

As a risk minimizer, you would choose Stock______ if it is to be held in isolation and Stock_________ if it is to be held as part of a well- diversified portfolio.

A) A; A.

B) A; B.

C) B; C.

D) C; A.

E) C; B.

Correct Answer:

Verified

Q5: Which is the best measure of risk

Q6: If the returns of two firms are

Q6: We will almost always find that the

Q7: A stock with a beta equal to

Q9: You have the following data on

Q12: In a portfolio of three different stocks,

Q14: The SML relates required returns to firms'

Q14: Stock A's beta is 1.5 and Stock

Q15: Which of the following is NOT a

Q17: If you plotted the returns of Selleck

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents