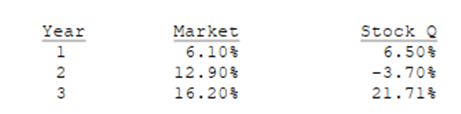

You are given the following returns on "the market" and Stock Q during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3. How different are those two betas, i.e., what's the value of beta 2 - beta 1? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.)

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q2: The CAPM is a multi-period model which

Q9: The slope of the SML is determined

Q12: It is possible for a firm to

Q13: The Y-axis intercept of the SML indicates

Q15: Which of the following is NOT a

Q18: Which of the following statements is

Q21: You hold a diversified portfolio consisting of

Q22: Which of the following statements is CORRECT?

A)

Q24: The returns on the market , the

Q25: Which of the following are the factors

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents