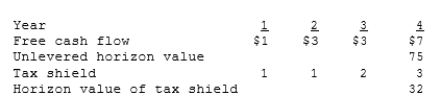

Brau Auto, a national autoparts chain, is considering purchasing a smaller chain, South Georgia Parts (SGP) . Brau's analysts project that the merger will result in the following incremental free cash flows, tax shields, and horizon values:  Assume that all cash flows occur at the end of the year. SGP is currently financed with 30% debt at a rate of 10%. The acquisition would be made immediately, and if it is undertaken, SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level. The interest rate would remain the same.

Assume that all cash flows occur at the end of the year. SGP is currently financed with 30% debt at a rate of 10%. The acquisition would be made immediately, and if it is undertaken, SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level. The interest rate would remain the same.

SGP's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8% and the market risk premium is 4%. What is the value of SGP to Brau?

A) $53.40 million

B) $61.96 million

C) $64.64 million

D) $76.96 million

E) $79.64 million

Correct Answer:

Verified

Q8: Since a manager's central goal is to

Q25: The rate used to discount projected merger

Q29: Coca-Cola's acquisition of Columbia Pictures and its

Q31: In a financial merger, the relevant post-merger

Q32: Dunbar Hardware, a national hardware chain, is

Q33: Which of the following are legal and

Q36: Which of the following statements about valuing

Q37: Great Subs Inc., a regional sandwich chain,

Q37: Discounted cash flow methods are not appropriate

Q38: Although goodwill created in a merger may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents