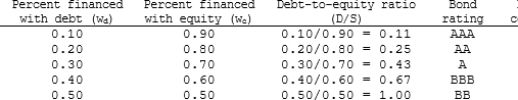

Aaron Athletics is trying to determine its optimal capital structure. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the

Following table:

The company uses the CAPM to estimate its cost of common equity, rs.

The risk-free rate is 5% and the market risk premium is 6%. Aaron estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is the company's optimal capital structure, and what is the firm's cost of capital at this optimal

Capital structure?

A) wc = 0.9; wd = 0.1; WACC = 14.96%

B) wc = 0.8; wd = 0.2; WACC = 10.96%

C) wc = 0.7; wd = 0.3; WACC = 7.83%

D) wc = 0.6; wd = 0.4; WACC = 10.15%

E) wc = 0.5; wd = 0.5; WACC = 10.18%

Correct Answer:

Verified

Q43: A group of venture investors is considering

Q44: A consultant has collected the following information

Q45: Lauterbach Corporation uses no debt, its beta

Q46: Michaely Inc. is an all-equity firm with

Q47: Powell Plastics, Inc. (PP) currently has zero

Q49: Dabney Electronics currently has no debt. Its

Q50: Which of the following statements is CORRECT?

A)

Q51: Which of the following statements is CORRECT?

A)

Q52: Senbet Ventures is considering starting a new

Q53: Stephens Electronics is considering a change in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents