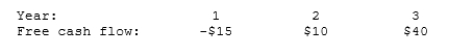

A company forecasts the free cash flows (in millions) shown below. The weighted average cost of capital is 13%, and the FCFs are expected to continue growing at a 5% rate after Year 3. Assuming that the ROIC is expected to remain constant in Year 3 and beyond, what is the Year 0 value of operations, in millions?

A) $315

B) $331

C) $348

D) $367

E) $386

Correct Answer:

Verified

Q7: Simonyan Inc. forecasts a free cash flow

Q8: If a company's expected return on invested

Q9: Leak Inc. forecasts the free cash flows

Q13: Two important issues in corporate governance are

Q13: Based on the corporate valuation model, Bernile

Q14: Value-based management focuses on sales growth, profitability,

Q15: Suppose Leonard, Nixon, & Shull Corporation's projected

Q16: Which of the following is NOT normally

Q17: Which of the following statements is NOT

Q35: Free cash flows should be discounted at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents