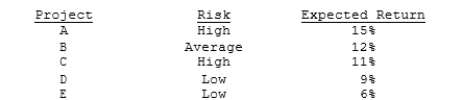

Langston Labs has an overall (composite) WACC of 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Langston evaluates low-risk projects with a WACC of 8%, average-risk projects at 10%, and high-risk projects at 12%. The company is considering the following projects:  Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

A) A and B.

B) A, B, and C.

C) A, B, and D.

D) A, B, C, and D.

E) A, B, C, D, and E.

Correct Answer:

Verified

Q37: Which of the following statements is CORRECT?

A)

Q38: A company is considering a new project.

Q40: Taussig Technologies is considering two potential projects,

Q41: Marshall-Miller & Company is considering the purchase

Q42: Which one of the following would NOT

Q44: Your company, CSUS Inc., is considering a

Q45: Clemson Software is considering a new project

Q46: A company is considering a proposed new

Q47: Which of the following rules is CORRECT

Q48: Your company, RMU Inc., is considering a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents