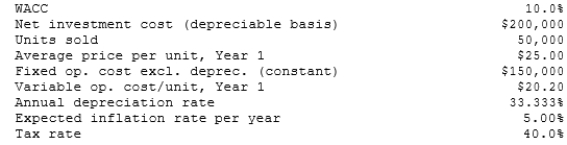

Thomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

A) $20,762

B) $21,854

C) $23,005

D) $24,155

E) $25,363

Correct Answer:

Verified

Q55: Which of the following statements is CORRECT?

A)

Q56: Temple Corp. is considering a new project

Q57: Dalrymple Inc. is considering production of a

Q58: Which one of the following would NOT

Q60: Sub-Prime Loan Company is thinking of opening

Q61: TexMex Food Company is considering a new

Q62: Florida Car Wash is considering a new

Q64: Poulsen Industries is analyzing an average-risk project,

Q65: Foley Systems is considering a new investment

Q66: Desai Industries is analyzing an average-risk project,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents