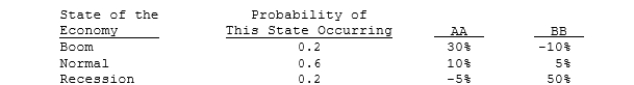

The distributions of rates of return for Companies AA and BB are given below:  We can conclude from the above information that any rational, risk- averse investor would be better off adding Security AA to a well- diversified portfolio over Security BB.

We can conclude from the above information that any rational, risk- averse investor would be better off adding Security AA to a well- diversified portfolio over Security BB.

Correct Answer:

Verified

Q25: If an investor buys enough stocks, he

Q27: We would generally find that the beta

Q28: Under the CAPM, the required rate of

Q29: A stock's beta is more relevant as

Q33: Any change in its beta is likely

Q34: The slope of the SML is determined

Q35: Portfolio A has but one security, while

Q36: We would almost always find that the

Q37: A portfolio's risk is measured by the

Q39: The CAPM is built on historic conditions,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents