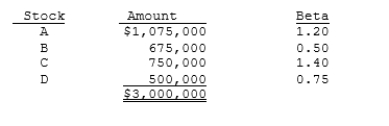

Assume that you are the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 5.00%. What rate of return should investors expect (and require) on this fund?

A) 10.56%

B) 10.83%

C) 11.11%

D) 11.38%

E) 11.67%

Correct Answer:

Verified

Q108: Bill Dukes has $100,000 invested in a

Q117: Desreumaux Inc's stock has an expected return

Q118: Choudhary Corp believes the following probability distribution

Q119: Wei Inc. is considering a capital budgeting

Q123: Stock A's stock has a beta of

Q123: Mikkelson Corporation's stock had a required return

Q125: Returns for the Dayton Company over the

Q138: Linke Motors has a beta of 1.30,the

Q139: Mulherin's stock has a beta of 1.23,its

Q144: CCC Corp has a beta of 1.5

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents